Day 1 Portfolio

Post 1 / x

The purpose of this blog is simply to document my portfolio, investment decision and thinking in real time for posterity.

My investing style is eclectic, reflecting my training. I've been fortunate to generate returns across a range of asset classes in different geographies: junk bonds, equities, structured products, real estate, and options. My approach emphasizes keeping an open mind and seizing opportunities wherever they arise.

At its core, investing is about keeping score. I've given myself three years—starting today—to prove that I can excel at this. My portfolio is heavily weighted toward international markets (>80%), and while I've done well against the international indexes, simply buying the SPY would have been a better financial choice in hindsight. Although what would I do with all my extra time?

Current Portfolio Positioning:

China Tech ETF, 22% Position:

Expressed via 3067.HK + KWEB + BEN notes that track both 3067.HK/KWEB

This is a simple bet that the pessimism on China has been taken too far, and that 10x P/E on trough earnings is too little.

While the vicious competitive environment in China has no parallel anywhere in the world, these ETFs own leading companies with dominant market positions (think Tencent with Wechat, Alibaba with Alipay, etc).

The companies are incredibly cash generative (Alibaba has ~40% of its market cap in cash) and have now started returning capital to shareholder by the truckload (JD has bought back 8.1% of its shares to end sept this year).

Buying KWEB or 3067.HK directly would be the simplest play, but because it is highly possible that the market takes a long time to recognize the value here, I'm converting my position slowly to a series of BEN notes (~1/3 of the exposure).

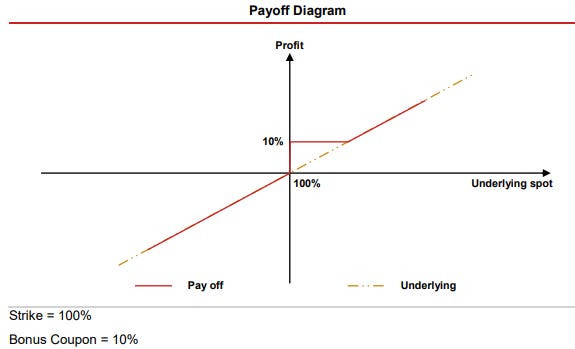

BEN Notes are structured products where you pick two underliers (3067 / KWEB in this case), and at the end of the contract period, they reference the worst of the two performers. If the worst underlier return <0% you take the downside 1:1. If performance is >0%, then you take a minimum return of the [coupon] or if higher, then you take the upside 1:1. So the payoff looks something like:

There’s no free lunch however, and in this particular instance, you take the default risk of the issuing bank (generally low in my view) and you give up the dividend (worthwhile in my view given the coupon).

As a live example of the coupons available, this was priced 19 Dec 2024:

You can do BENs in any tenure, at a discount to market, etc. Because stocks move for any variety of reasons, I've chosen 3067.HK + KWEB, which are two ETFs tracking China Tech, main difference being KWEB holds US listed names and 3067.HK holds HK listed names. There are some significant differences (i.e. PDD or Xiaomi), but most large chinese tech companies are duo listed, and the two ETFs generally move together.

I’ve chosen to pursue this strategy as the step-function improvement in returns in a positive price scenario vastly outweighs giving up the dividend or the slight risk in the composition of the ETFs. At the end of the day, I’m going long China Tech beta with a potential returns kicker.

Structured products are interesting when volatility is high, or market sentiment is at an extreme. Not to be used liberally, but in small targeted doses, I feel pretty good about them.

More to come on this position at a later date.

AJSS. 20% Position.

Japan is an incredibly exciting market. The market is cheap, especially at the smaller end of things, but cheapness in itself is not a great place to be - I have the scars to prove it.

BUT in Japan, with the corporate governance reform that is happening, more and more activists showing up, you have a potent catalyst for a market filled with previously classic value traps. Most companies do not have controlling shareholders (perhaps given taxes), and where there are cross shareholdings and parent companies pulling strings, the government is doing everything it can to unwind such influence.

As a first step, I want Japan beta -> Japan small cap beta -> small cap beta + activist catalyst. As we go along, I will take stock specific exposure, but in the meantime, I want on the Japan train NOW.

The best option I’ve found is AJSS, the UCITS version of AJOT, with some modifications to fit the rules. It’s a publicly traded close end trust with annual liquidation which allows for a tight NAV spread (look at PSH for how much NAV vs stock price can blow out). AVI is incredibly active in Japan, and they are thoughtful with the work they do.

This is currently a 20% allocation in JPY, 50% funded in USD + 50% funded with a JPY margin loan at 1% per year. One thing I have never been able to figure out is currency. That said, Japan just feels incredibly cheap and JPY just feels mis-priced), so I'm happy to take a 10% exposure to the Yen. If it move another 30% to ~200 USDJPY, that's a 3% hit to the book - manageable. USJPY feels intuitively that it should be closer to 100 vs 200, although I admit this could swing either way.

I believe this strategy should return a minimum of 10% per year gross, which after deducting a 1% margin cost will be 19% on the net 10% equity exposure.

The are fairly public about their positions and view, more information here: www.assetvalueinvestors.com/ajot/

I’ve posted plenty on Japan and you can follow me here to read more: www.x.com/thelonghappy

More thoughts to come.

Paraphrasing Kerrisdale this is not investment advice, and “is provided to you solely for your own entertainment purposes”

Thanks for the explanation on the structured products. First time I hear about them.

AJSS/ AJOT sound great - trying to find an equivalent for US based investors.