Synchro Foods $3963.T

Join the Party!?

Continuing to surf in the wake of activists, Synchro Foods is the highlight of the day. Just a quick post to highlight what I am seeing.

Company Overview

Synchro Food was founded in 2003 and provides a comprehensive suite of tools for restaurant operators. With a growing base of over 311,069 restaurant operators and 351,117 jobseekers, Synchro generates substantial revenue through targeted advertisements on its platform.

Financial Performance

Synchro has seen ~15% average revenue annual growth with EBIT margins that are consistently in the high 20s. The business is high cash generative, with an OCF yield of ~5% and limited Capex requirements.

Synchro Food has two main business lines - Media Platform and M&A Brokerage

Per CapitalIQ, “Synchro Food Co., Ltd. operates various media platforms for the food and beverage industry. Its platforms include Ryokuten.com, a support site for opening and operation of restaurant; Jobs@Restaurant.com, a restaurant job information site; Jobs@Interior Design, a job search site for the interior industry; Store Design.com, a matching site for store design companies; Ryokuten.com Unoccupied Sales, a purchase appraisal site for unoccupied stores; and Mobimaru, a kitchen car share matching site.”

In 2024, Synchro Food captured an 11.4% share of the nationwide job posting services market, with a dominant 33.8% share in Tokyo, Japan’s restaurant hub. With 60% of aspiring restaurateurs being new to the industry, Synchro is well-positioned to meet growing demand. To further accelerate expansion, the company plans to extend its presence beyond Tokyo, Osaka, and Nagoya, combining direct sales and distributor channels for nationwide growth.

There is also a much smaller M&A Brokerage which is highly volatile with fluctuating margins, but an important complimentary offering to its core business.

Valuation:

Synchro currently trades at 12x 2024 EBITDA, with ~30% of its market cap in cash. The company just paid a ¥15 dividend last month for a 2.5% yield. From CIQ below:

Register & Shareholders:

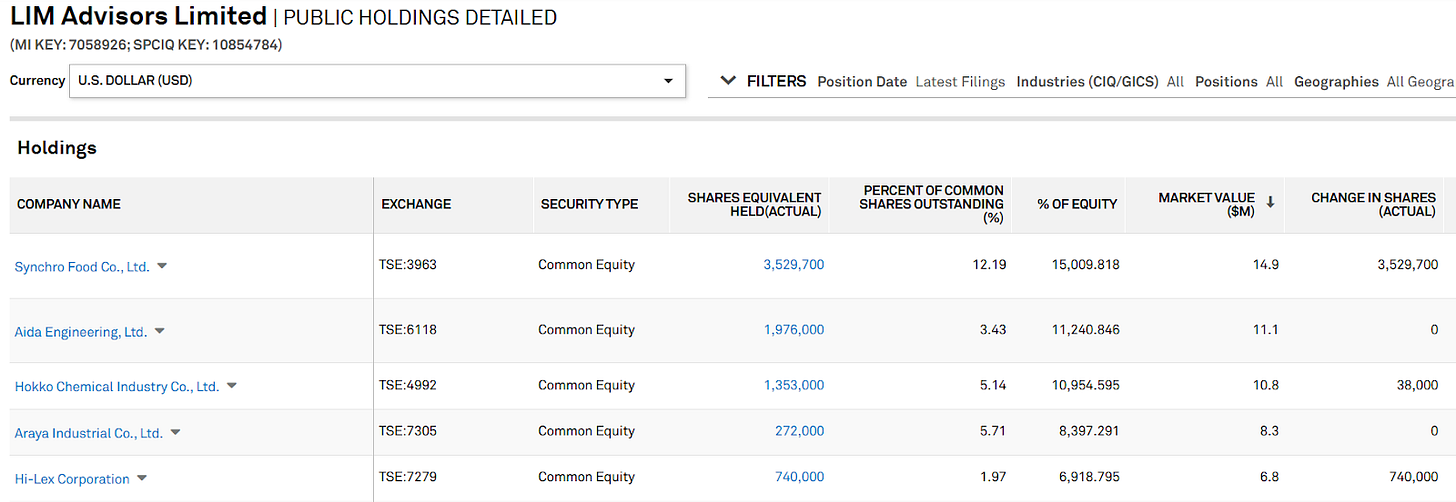

What makes Synchro particularly appealing to me, is the presence of both AVI and LIM Advisors, two of the most active and successful small cap activists

AVI has been actively acquiring shares in Synchro throughout March and April. On 9 April 2025 AVI declared a 10.06% shareholding in the company, having paid an average of ¥479/share.

LIM Advisors 31 March 2025 declared a 12.12% shareholding in Synchro having paid an average of ¥412/share.

Disclosures here on Edinet

As a result, what you have now is an incredibly stacked register, with the combination of LIM, AVI, VIS, Grandeur Peak, and SPARX owning 39% of the company! I feel like I’ve seen this movie before…!

It is even more noteworthy that LIM Advisors, which has seen incredible success in its engagements of late, deems Synchro worthy of being its’ largest holding.

Conclusion:

I am long just based on the register alone. But paraphrasing Kerrisdale this is not investment advice, and “is provided to you solely for your own entertainment purposes”.